Table of Contents

- Navigating the 2025 Tax Landscape: Changes on the Horizon for Taxpayers

- The reason why you may have to pay MORE tax in 2026 | Daily Mail Online

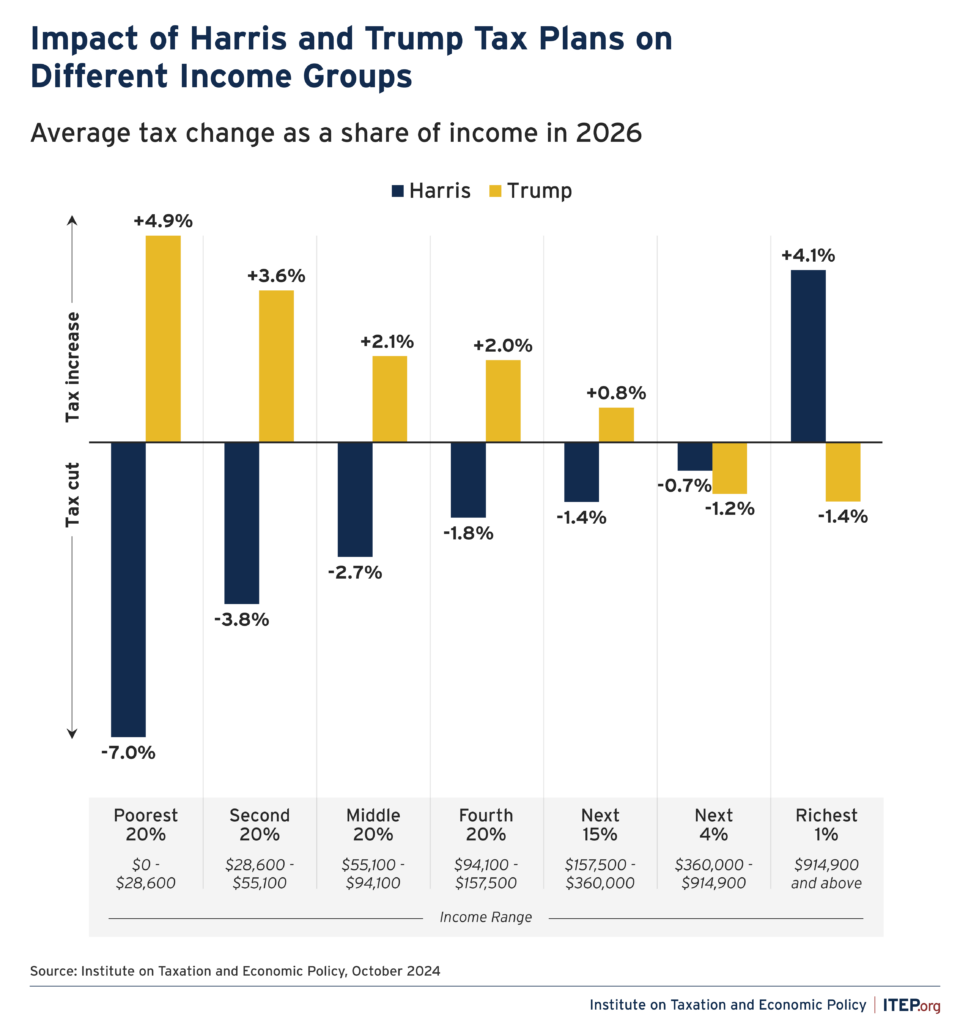

- How Would the Harris and Trump Tax Plans Affect Different Income Groups ...

- TCJA Expiring: Taxes Are Set to Increase in 2026

- 2025 Vs 2026 Tax Brackets - List of Disney Project 2025

- Estimated Tax Brackets For 2024 - Elna Noelyn

- Will Tax Rates Sunset In 2026? How to Plan Ahead - YouTube

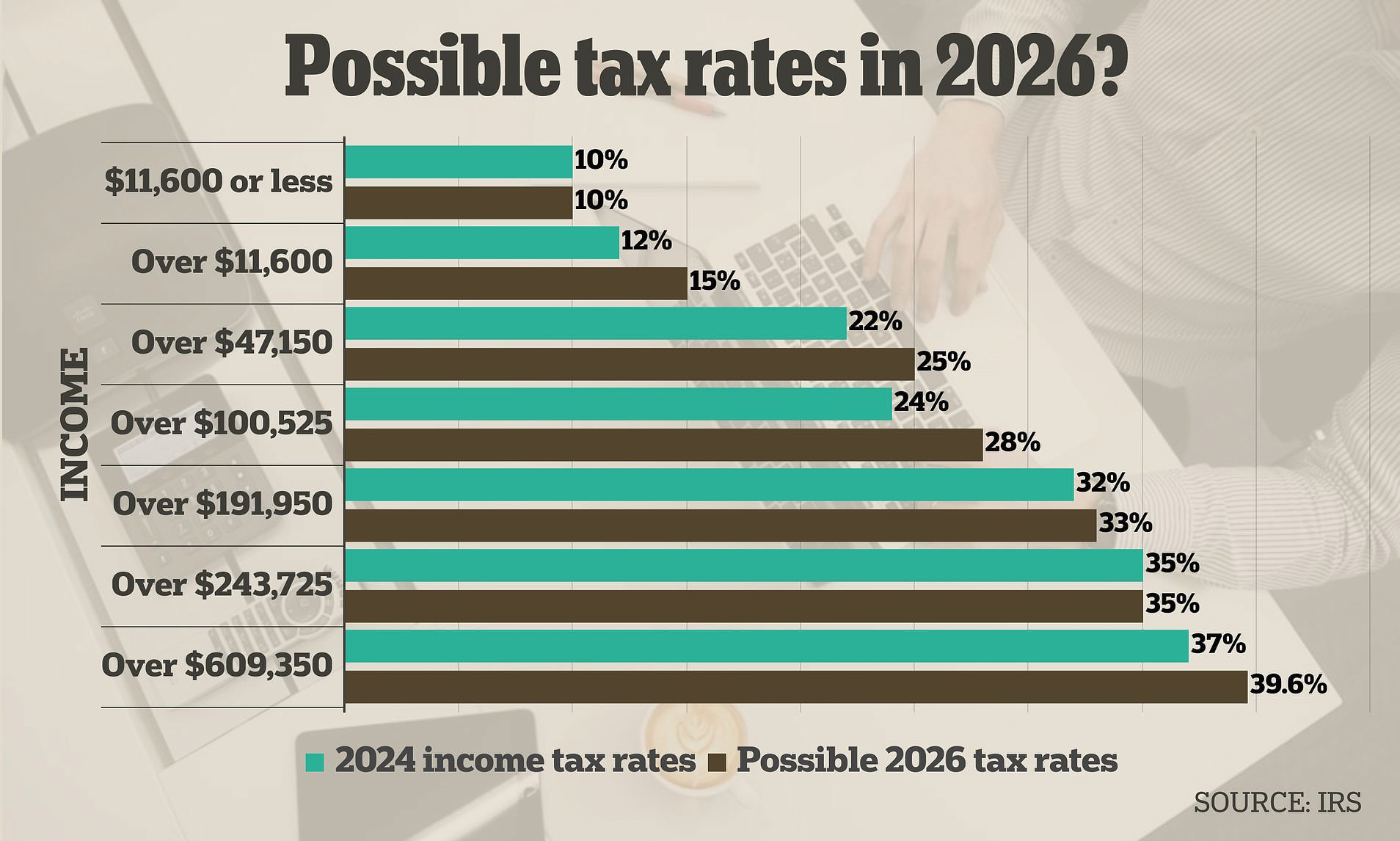

- The reason why you may have to pay MORE tax in 2026

- Tax Brackets For 2024 Head Of Household And Single - Teena Genvieve

- The reason why you may have to pay MORE tax in 2026 | Daily Mail Online

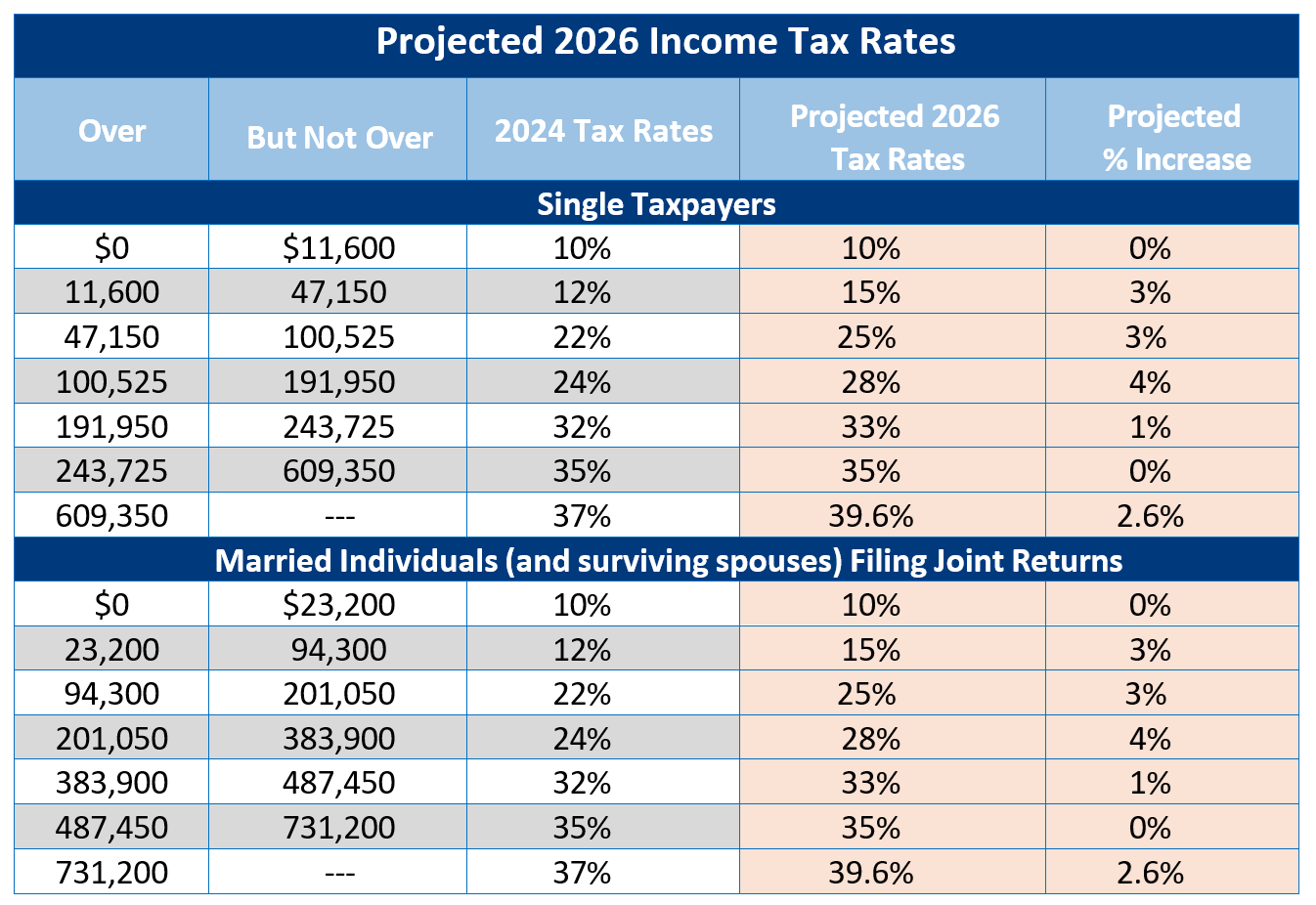

Tax Brackets and Rates for 2025

Tax Brackets and Rates for 2026

Tax Brackets and Rates for 2027

The tax brackets and rates for 2027 are expected to be: 10%: $0 to $11,400 (single) or $0 to $22,800 (joint) 12%: $11,401 to $45,700 (single) or $22,801 to $91,400 (joint) 22%: $45,701 to $97,200 (single) or $91,401 to $194,400 (joint) 24%: $97,201 to $184,900 (single) or $194,401 to $369,400 (joint) 32%: $184,901 to $235,700 (single) or $369,401 to $471,400 (joint) 35%: $235,701 to $589,300 (single) or $471,401 to $711,400 (joint) 37%: $589,301 or more (single) or $711,401 or more (joint)